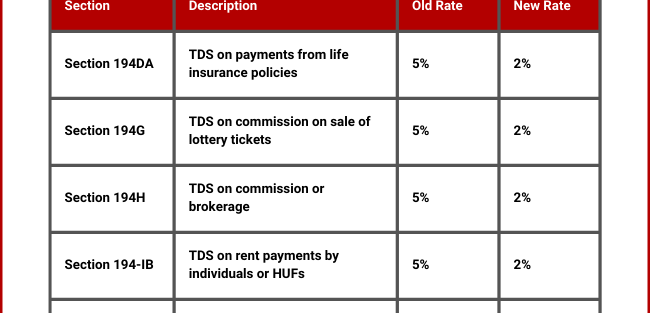

TDS on payments from Life insurance policies (Section 194DA): There is a reduction of TDS rate on payments from life insurance policies from 5% to 2%.

TDS on commission on sale of lottery tickets (Section 194G): There is also a reduction in TDS rate on commissions from lottery ticket sales. The new TDS rate is 2%. Earlier this rate was 5%.

Commission or Brokerage TDS (Section 194H): As per the earlier rates, there was a deduction of 5% TDS on commission or brokerage. But w.e.f., from October 1, 2024, this rate is now 2%.

TDS on rent payments by individuals or HUFs (Section 194-IB): Rent payments made by individuals or HUFs will now face a 2% TDS rate. Earlier, this rate was also 5%.

Certain payments by individuals or HUF (Section 194M): Now, there will be a 2% TDS on certain payments made by individuals or HUF. Earlier, this rate was also 5%.

TDS on payments by E-commerce operators (Section 194-O): Payments by e-commerce operators to participants will now attract a TDS rate of 0.1%, down from 1%.

Mutual funds repurchase (Section 194F): In addition to the above the TDS rate changes, there is an omission of TDS on repurchases by mutual funds or Unit Trust of India from the Income Tax Act. This is to say, that w.e.f., 1st October 2024, Section 194F will not be applicable.

Also Read: TDS Rate Chart FY 2024-2025 | AY 2025-2026: All You Need To Know