After the issue of this Rule, there was still confusion regarding the order of utilising of ITC after it has been utilised for IGST liability. Therefore, the clarification to the said circular was issued on 23.04.2019, which is as follows:

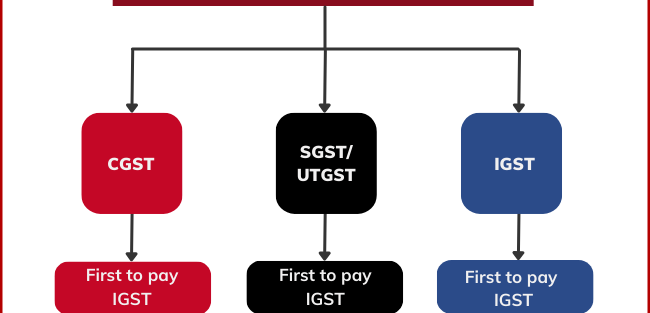

As per the Circular No: 98/17/2019 dated 23 April 2019, it has been clarified that- As per the provisions of Section 49 of the CGST Act, credit of integrated tax has to be utilised

– Firstly, for payment of integrated tax,

– Secondly, for payment of Central tax and

– Lastly, for payment of State tax, in that order mandatorily.

Also Read: Know Everything About GST ITC On Bank Charges

This led to a situation, in certain cases, where a taxpayer has to discharge his tax liability on account of one type of tax (say State tax) through electronic cash ledger, while the input tax credit on account of other types of tax (say Central tax) remains unutilised in electronic credit ledger.

The newly inserted rule 88A in the CGST Rules allows utilisation of input tax credit of integrated tax towards the payment of Central tax and State tax, or as the case may be, Union Territory tax, in any order subject to the condition that the entire input tax credit on account of integrated tax is completely exhausted first before the input tax credit on account of Central tax or State/Union Territory tax can be utilised.

It is clarified that after the insertion of the said rule, the order of utilisation of input tax credit will be as per the order (of numerals) given below:

Setting off of ITC

| Liability/ITC | IGST | CGST | SGST |

| IGST | 1 | 2 | 3 |

| CGST | 2 | 1 | Not allowed |

| SGST | 2 | Not allowed | 1 |