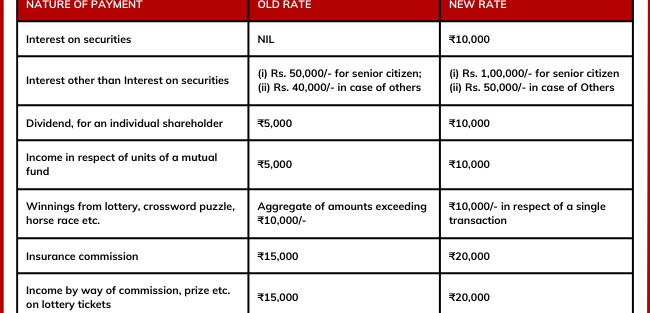

Understanding the TDS rates applicable for different transactions as well as recipients is crucial for compliance with tax laws. Further, timely deduction and deposit of TDS help avoid penalties and interest charges. Whether you are a business owner, salaried individual, or investor, staying updated with TDS provisions ensures smooth financial transactions and tax compliance.

For any queries or assistance with TDS compliance, feel free to reach out to TaxHelpdesk for expert guidance!

If you want to plan your taxes, then you must act now and optimize your taxes with the help of TaxHelpdesk. Also, do not forget to follow us on Facebook, Instagram, LinkedIn and Twitter.