The Income Tax Act provides certain exemptions on sale of house property having long term gains. These exemptions are provided under Section 54 and Section 54EC.

Section 54:

Section 54 gives relief to a taxpayer who sells his residential house and from the sale proceeds he acquires another residential house. Further, in order to avail the exemption under Section 54, certain conditions must be fulfilled, which are as follows:

– The benefit of section 54 is available only to an individual or HUF.

– The asset transferred should be a long-term capital asset, being a residential house property.

– Within a period of one year before or two years after the date of transfer of old house, the taxpayer should acquire another residential house or should construct a residential house within a period of three years from the date of transfer of the old house. In case of compulsory acquisition the period of acquisition or construction will be determined from the date of receipt of compensation (whether original or additional).

Note:

With effect from Assessment Year 2021-22, the Finance Act, 2020 has amended Section 54 to extend the benefit of exemption in respect of investment made in two residential house properties. The exemption for investment made, by way of purchase or construction, in two residential house properties shall be available if the amount of longterm capital gains does not exceed Rs. 2 crores. If assessee exercises this option, he shall not be entitled to exercise this option again for the same or any other assessment year.

Illustration

Mr. Raj purchased a residential house in April, 2023 and sold the same in April, 2024 for Rs. 8,40,000. Capital gain arising on sale of house amounted to Rs. 1,00,000. Can he claim benefit of section 54 by purchasing/constructing another residential house from the capital gain of Rs. 1,00,000?

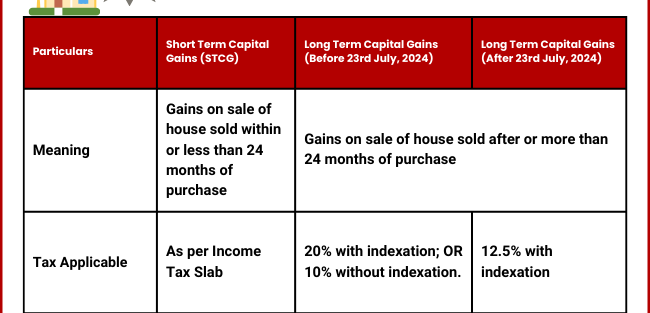

– Exemption under section 54 can be claimed in respect of capital gains arising on transfer of capital asset, being long-term residential house property. With effect from assessment year 2018-19, the period of holding in case of immovable property, being land or building or both, is reduced from 36 months to 24 months, to qualify as long-term capital asset. In this case the house property is sold after holding it for a period of less than 24 months and, hence, it is a short-term capital asset. The benefit of section 54 is not available in respect of a short-term capital asset and, hence, in this case Mr. Raj cannot claim the benefit of section 54.

Illustration

Kumar HUF purchased a residential house in April, 2016 and sold the same in April, 2024 for Rs. 8,40,000. Capital gain arising on sale of house property amounted to Rs. 1,00,000. Can the HUF claim the benefit of section 54 by purchasing a new house from the capital gain of Rs. 1,00,000?

– Exemption under section 54 can be claimed in respect of capital gains arising on transfer of capital asset, being long-term residential house property. This benefit is available only to an individual or HUF. In this case all the conditions as provided in section 54 are satisfied and, hence, Kumar HUF can claim the benefit of section 54 by purchasing/constructing a residential house within the time-limit as provided under section 54.

Amount of exemption under Section 54

Exemption under section 54 will be lower of following :

Amount of capital gains arising on transfer of residential house; or

Amount invested in purchase/construction of new residential house property [including the amount deposited in Capital Gains Deposit Account Scheme].

Capital Gain Deposit Account Scheme

To claim exemption under section 54, the taxpayer should purchase another house within a period of one year before or two years after the date of transfer of old house or should construct another house within a period of three years from the date of transfer. If till the date of filing the return of income, the capital gain arising on transfer of the house is not utilised (in whole or in part) to purchase or construct another house, then the benefit of exemption can be availed by depositing the unutilised amount in Capital Gains Deposit Account Scheme in any branch of public sector bank, in accordance with Capital Gains Deposit Accounts Scheme, 1988 (hereafter referred as Capital Gains Account Scheme). The new house can be purchased or constructed by withdrawing the amount from the said account within the specified time-limit of 2 years or3 years, as the case may be.

Section 54EC

There may be cases where the seller may not be wanting to buy another residential property (which is a necessity for claiming exemption under Section 54). In such a case, they still can claim exemption on long term capital gains on sale of house property by reinvesting the money in specified bonds.

Section 54EC allows exemption of LTCG on sale of land and building, if the profit is reinvested in certain specified bonds, within six months from the date of sale of the house.

Having stated that, the specified bonds include those issued by

– The Railway Finance Corporation,

– The National Highways Authority of India,

– The Rural Electrification Corporation, etc.

Note:

The upper limit is capped at Rs 50 lakhs, for this investment with a lock-in period of five years. More importantly, this exemption is available on sale of residential, as well as non-residential properties. The interest earned on these bonds, which is 5.25% annually, is entirely taxable. However, the maturity proceeds of the bonds are fully tax-free.

Now that you know the implications and capital gains on sale of house, make sure that you make the best use of the points mentioned above.

However, if you still have doubts regarding capital gain on sale of house property, then leave a comment below or reach out to the TaxHelpdesk’s experts today. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and Linkedin!

The views of the author are personal. TaxHelpdesk does not owe any responsibility towards anyone with regard to this blog!