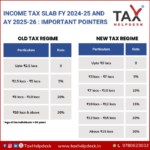

20% (if PAN is not furnished – Budget 2023)

8% Savings (Taxable) Bonds 2003 or 7.75% Savings (Taxable) Bonds 2018- 10,000

Other securities- No limit

(Through Budget, 2023 exemption of TDS on interest from listed debentures has been removed. Therefore, tax is to be deducted on interest on such specified securities)

Others- 40,000

Aggregate transactions- 1,00,000

Other than individuals/HUFs – 2%

ii) Companies

15000

(Budget 2024 – This rate is reduced to 2% with effect from 1st April 2025)

10%

Budget 2024 – This rate is reduced to 2% with effect from 1st October 2024

*This rate shall be increased by applicable surcharge and 4% cess

Budget 2024 –

This section is proposed to be omitted with effect from 1st October 2024

Budget 2024 – This rate is reduced to 2% with effect from 1st October 2024

Budget 2024 – This rate is reduced to 2% with effect from 1st October 2024

Budget 2024 – This rate is reduced to 2% with effect from 1st October 2024

*This rate shall be increased by applicable surcharge and 4% cess

Budget 2024 – This rate is reduced to 2% with effect from 1st October 2024

Others: 1 crore

-1 crore

5%

*If cash is withdrawn by a co-operative society the limit shall be Rs 3 Crore instead of Rs 1 Crore

(5%, in case PAN is not furnished)

Others- 10,000

If the agreement for such royalty payment is entered in between 31st March 1961 and 1st April 1976

If the agreement for such royalty payment is entered after 31st March 1976

If the agreement for such payment is entered in between 29th February 1964 and 1st April 1976

If the agreement for such payment is entered after 31st March 1976

Payment to non-filers, i.e. those who have not filed their income tax return in the last year

Non filers do not include:

– People who are not required to file their ITRs

– NRs who do not have a PE in India

– 5%, whichever is higher