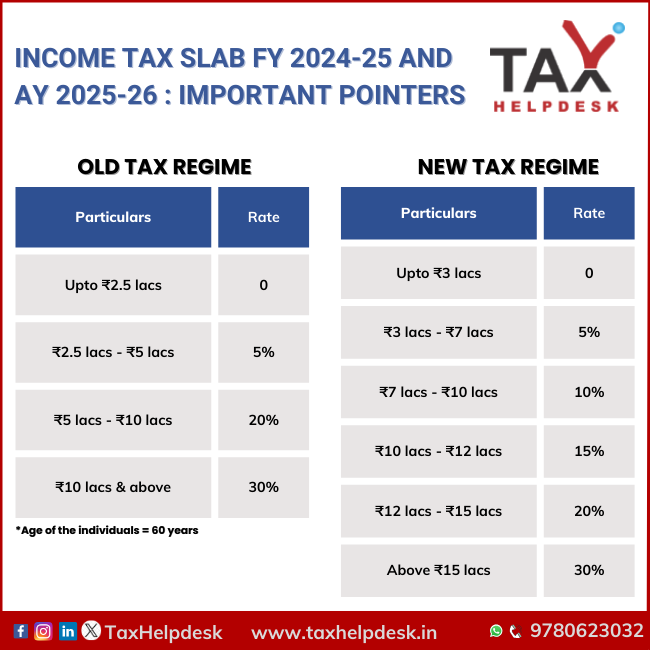

Income Tax Slab FY 2024-25 and AY 2025-26 : Important Pointers

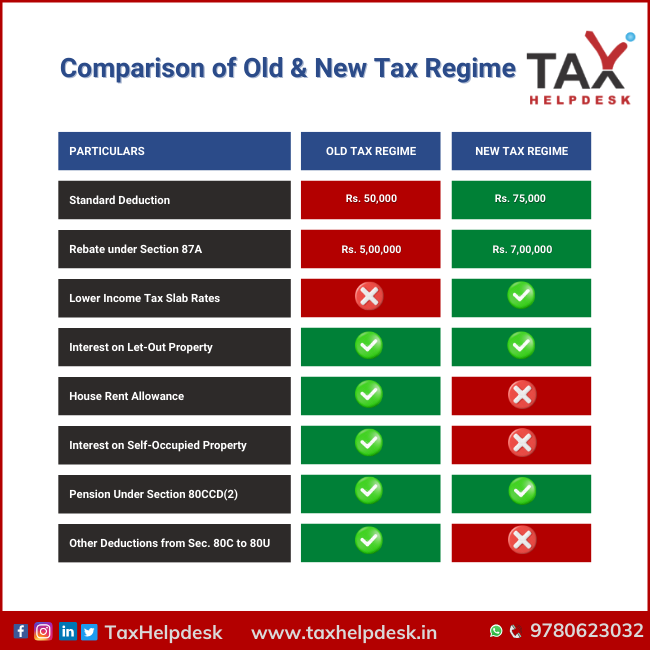

Old Tax Regime (FY 2022-23, FY 2023-24 and FY 2024-25) New Tax Regime Income Tax Slabs Below 60 years Between 60-80 years Above 80 years FY 2022-23 FY 2023-24 FY 2024-25 Up to ₹2,50,000 NIL NIL NIL NIL NIL NIL ₹2,50,001 – ₹3,00,000 5% NIL NIL 5% NIL NIL ₹3,00,001…