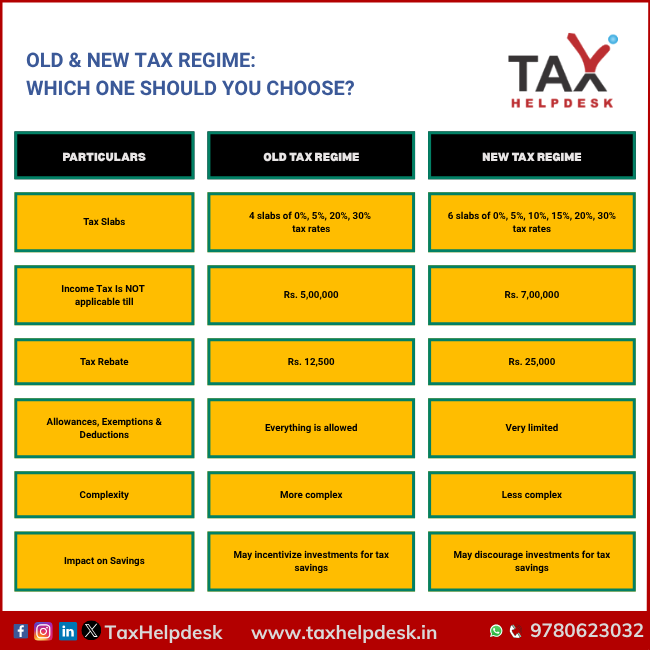

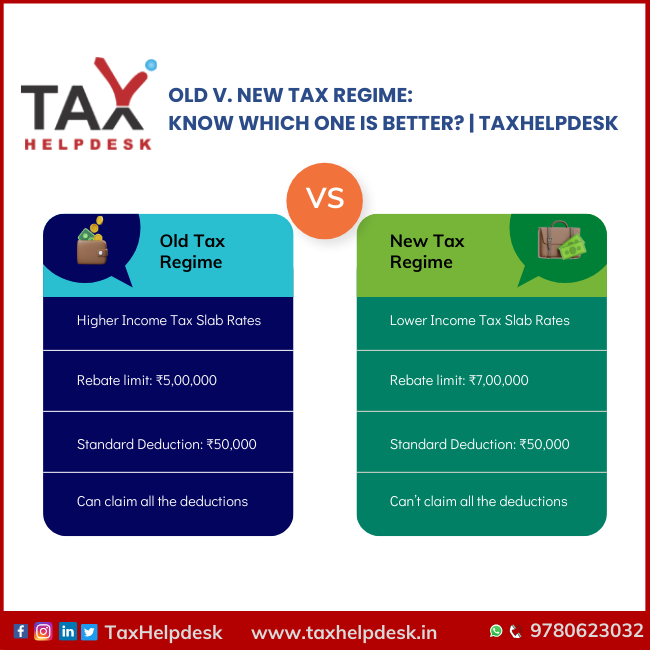

Old & New Tax Regime: Which One Should You Choose?

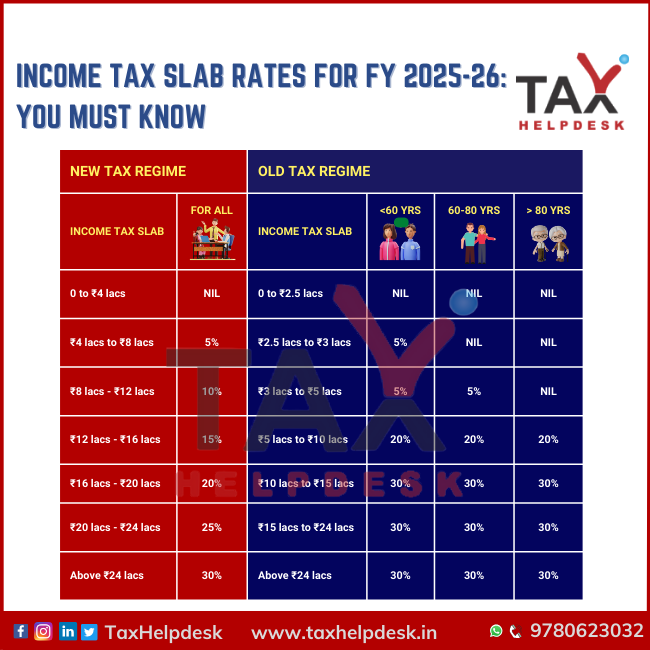

Old & New Tax Regime offer two different ways to calculate and pay your income tax. One focuses on savings and deductions. The other focuses on simplicity and clarity. Both … Old & New Tax Regime: Which One Should You Choose? Read More » The post Old & New Tax…